The Mars Market Update

A structured, technical analysis outlook designed to help traders stay oriented and prepared in global markets. Start a TrialInside The Mars Market Update

Each week, The Mars Market Update provides a structured, technical outlook across global asset markets.

Our analysis distils price action into a probabilistic view of market structure, giving traders the context and parameters they need to plan for opportunity, adapt to change, and manage risk.

Our research is presented through annotated charts with concise commentary, designed to fit seamlessly into your process.

Here’s what to expect from our analysis each week;

A Probabilistic, Technical Outlook For Markets

Using our structured framework, we update and identify key directional trends and a probabilistic “price path” view of the outlook that highlights what may come next, inflection zones, turning points, and critical price parameters.

Analysis is presented across multiple timeframes, keeping short-term and long-term turning points in view.

Our framework enables us to present scenarios when the market structure is changing – helping traders prepare amid uncertainty.

Understanding the key directional trends across multiple timeframes and asset markets is key to supporting the trader’s process – across planning, execution, and risk management. Our approach helps traders stay aligned within the trend and broader macro landscape.

Context to stay oriented within the trend.

Cross-Market Context & Perspective

Our proprietary approach helps traders define key levels and identify trends and inflection zones across asset markets.

Our work combines Elliott Wave theory, Fibonacci analysis, intermarket relationships, sentiment, and traditional technical indicators into a cohesive analytical framework.

This disciplined and consistent approach helps frame the market so you remain focused on opportunities and potential turning points with clarity and context.

A technical analysis framework to identify inflection zones and big picture turning points.

Coverage Across Global Macro Asset Markets

This comprehensive coverage provides a clear read of the pulse of macro asset markets.

We present a concise, yet detailed technical outlook across key markets including equity indices (SPX, Nasdaq, DJIA, Russell 2000, VIX); bonds (TLT, ZB, ZN, ZF); precious metals (Gold and Silver); commodities (Crude Oil, Natural Gas, Copper, Gasoline), FX (DXY, Euro, Yen, Pound, Aussie); and crypto (incl. Bitcoin).

We will also periodically highlight other individual markets for detailed analysis as specific opportunities arise.

Technical analysis that helps traders cut through the noise.

What We Deliver

The Mars Market Update is delivered weekly

Each Market Update presents our analysis through annotated charting and succinct commentary, designed to fit seamlessly into your process.

Midweek Charts + Client Q&A (as needed)

Intra-week updates and direct Q&A access for subscribers who want to explore chart logic or seek clarification.

Full Archive Access

Explore prior updates to follow market evolution, revisit key turning points, and build a deeper understanding of our approach.

The Weekly Macro Outlook Note

A separate briefing that steps back from the price action – to provide a contextual snapshot of current macro events and the week ahead. The Macro Outlook Note focuses on key data releases & expectations, central bank events, and other key macro drivers.

Stay Oriented. Stay Prepared.

Start your week with the Mars Market Update – an in-depth, structured technical outlook for global markets.

No long-term commitment. Just analysis that keeps you aligned and ready for what’s next.

A Trusted Layer of Technical Analysis For Your Process

The Mars Market Update is used by hedge fund managers, CIOs, macro analysts, and professional traders who rely on a structured, forward-looking lens to maintain perspective in global markets. Whether you’re building a thesis, stress-testing an idea, or staying aligned in a shifting environment, the Mars Market Update is designed to fit seamlessly into your process.

Anchor your market outlook with a clearly structured view of major asset markets.

Maintain focus on opportunities and potential turning points with clarity and context.

Stress-test ideas and positioning against an independent, disciplined framework.

Define key levels and inflection zones to support planning, execution, and risk management.

Stay aligned with the broader macro landscape, without distraction.

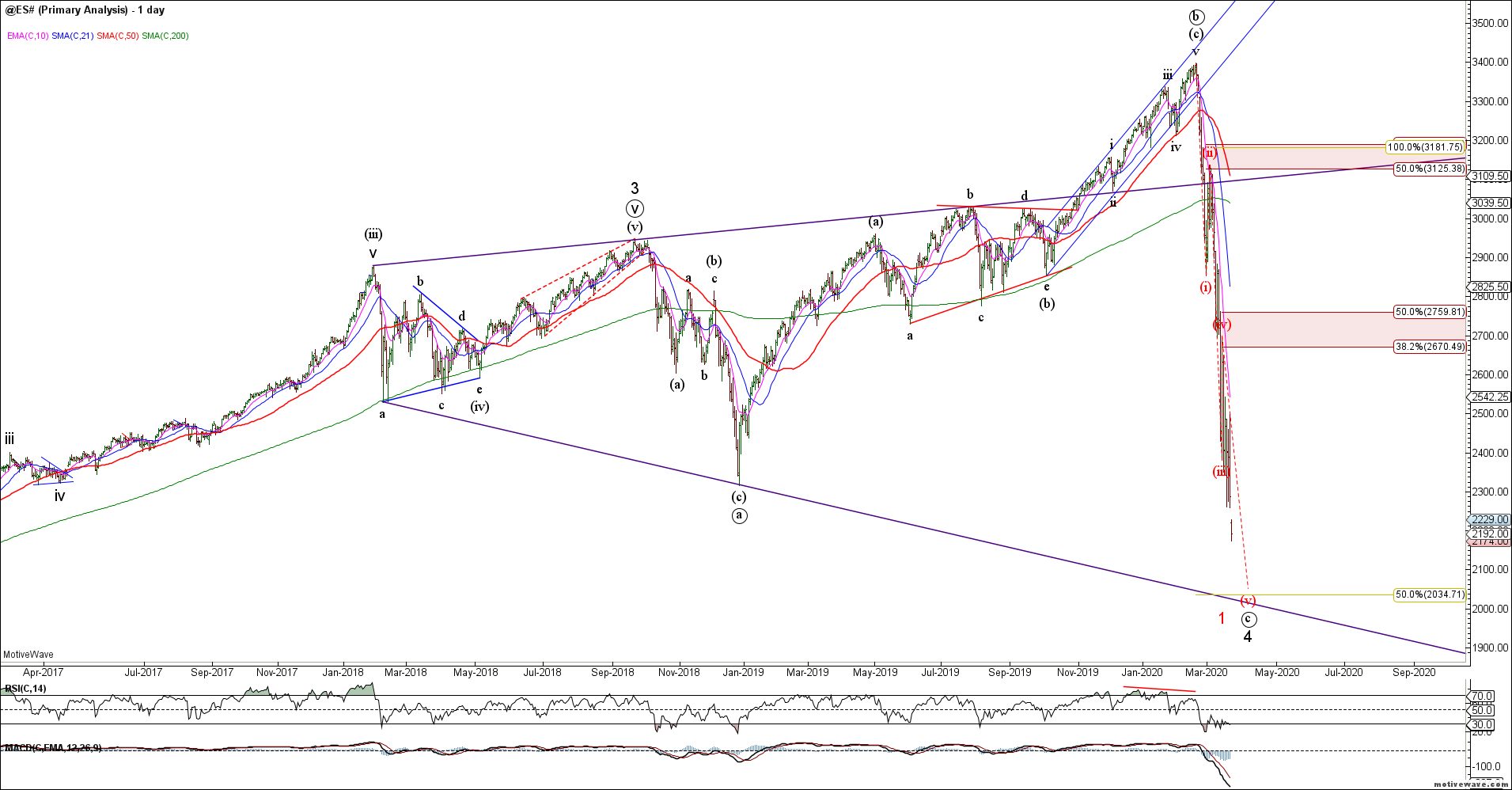

Price Action Told the Real Story

In these key market moments, our analysis stayed grounded in structure – even when the narrative said otherwise…

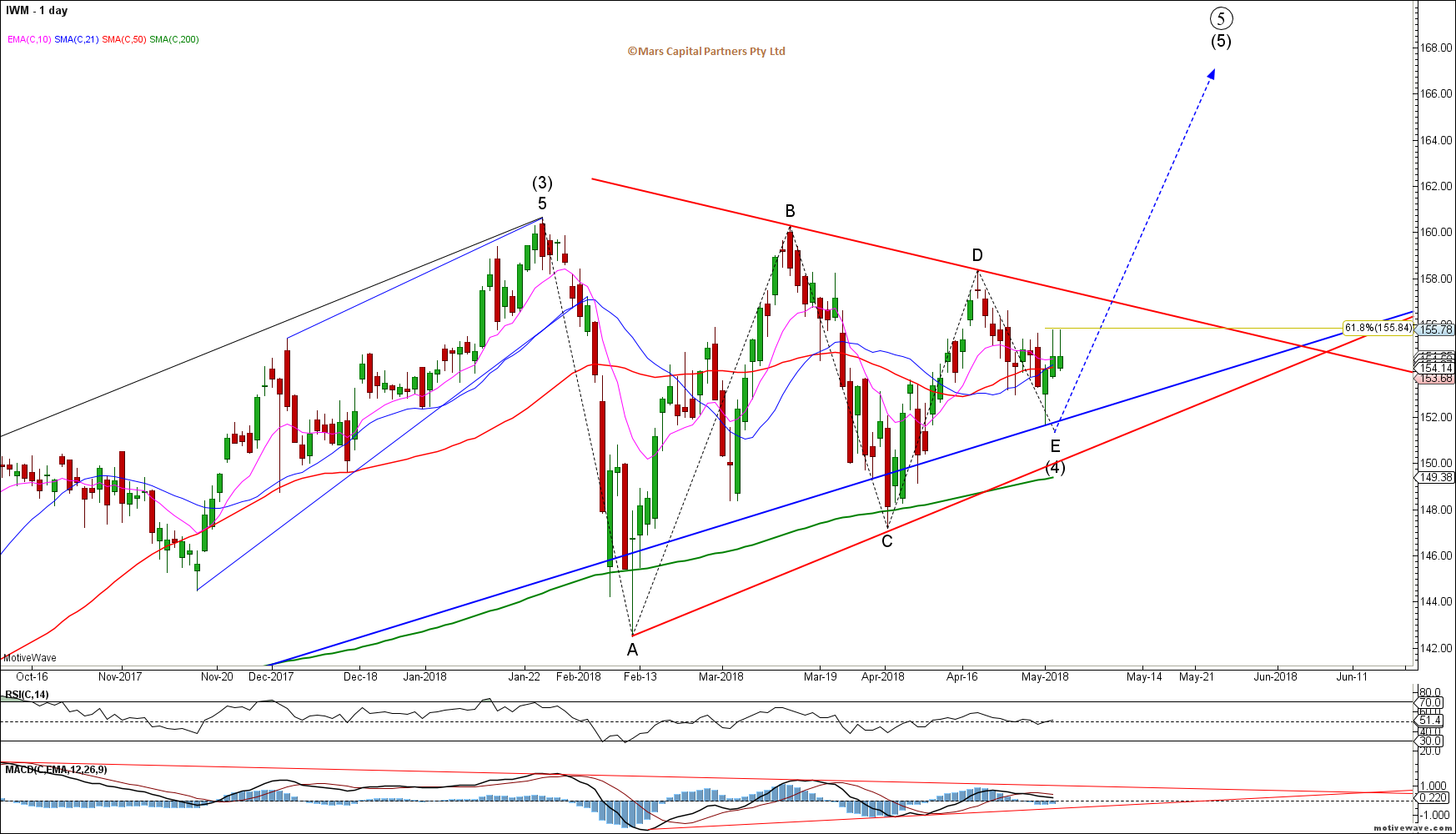

MCP Market Update: May 3rd, 2018 – Triangles

Elliott Wave Triangles usually occur in 4th waves. They occur when a market has rallied too far too fast and the market needs to correct time and price in a primary trend. read more...

MCP Market Update: January 16th, 2018 – Blow-off or Acceleration?

US equity markets continued to rally strongly to the point of rising exponentially over the first couple of weeks of 2018… I find it unusual for equity markets to accelerate this late in the cycle . read more…

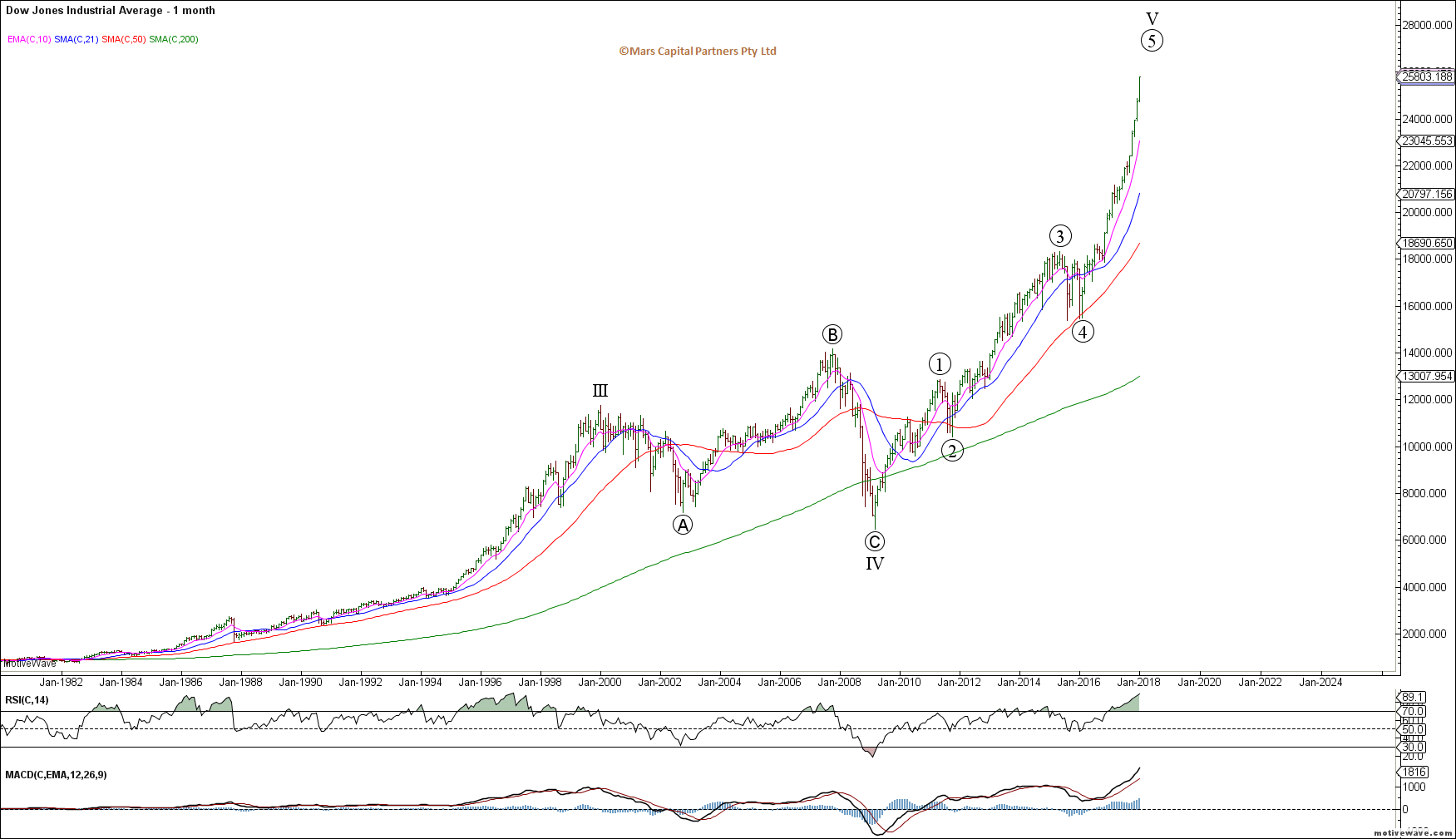

MCP Market Update: January 2nd, 2018 – The Year Ahead

As we look forward towards 2018, let’s focus on some bigger picture themes: Equity markets topping in 2018; bearish bonds, bullish US$ and bearish commodities – particularly Crude Oil… read more…

Independent Perspective. Proven Experience. Technical Clarity.

Authored by a seasoned market expert with 30 years of experience in financial markets.

Built on a proprietary framework honed through real-world market practice.

Institutional-grade insight at a cost-effective price.

Integrates into professional workflows, seamlessly.

Delivered with consistency and focus – led by a disciplined analysis of the market price action.

Structured Technical Insights for Macro Asset Markets

Independent, structured technical insights that keep you oriented in global markets — and ready for what’s next.

◻️ Institutional-quality technical analysis.

◻️ Forward-looking view of global markets.

◻️ Designed for professional traders and macro thinkers.