MCP Market Update: March 20th, 2017 – Bullish Bonds

MCP Market Update: March 13th, 2017 – Beware the Ides of March

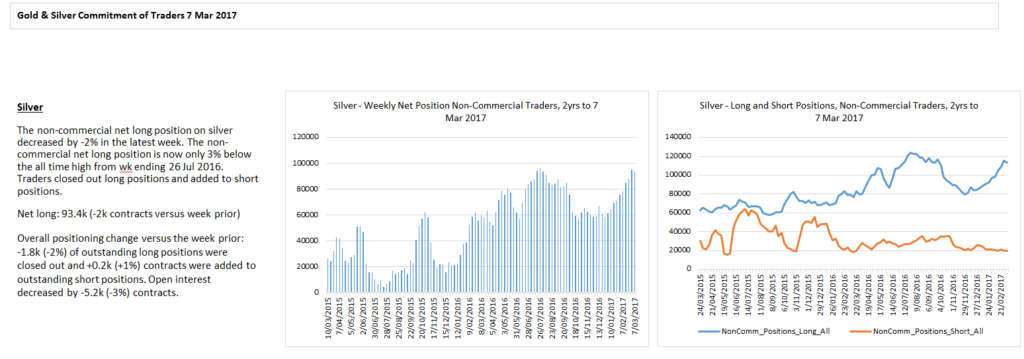

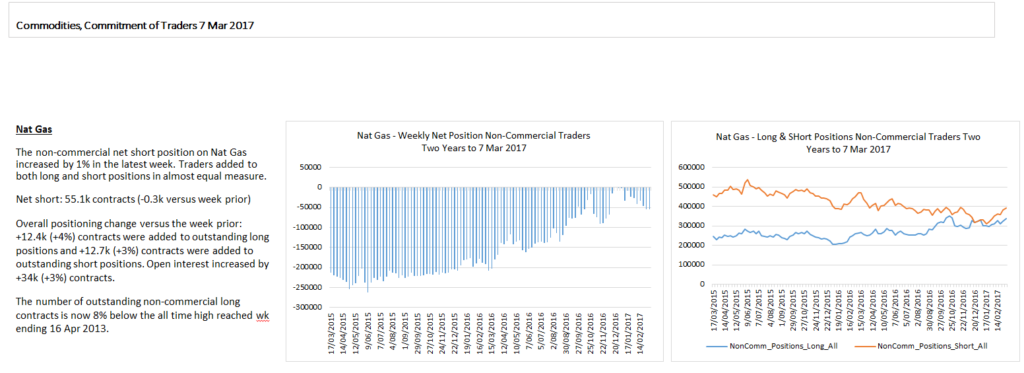

Fractures in the global equity markets continued last week. I continue to believe we are in an intermediate degree 4th wave (which are almost impossible to trade effectively). A number of global equity markets appear to be topping while commodity bulls have been killed. Crude Oil, Dr Copper and Silver are all good examples of what happens when all traders are on the same side of the boat – it eventually tips. This is why we follow the COT and sentiment data closely – it tells us when to bet against the herd. The consistent theme here is that we are looking for near term market tops across a broad spectrum of global equity indices.

My themes for this week are for continued US$ weakness while looking for a bullish reversal in US bonds and Precious Metals. Equities will remain tricky to trade as we whipsaw through this 4th wave correction.

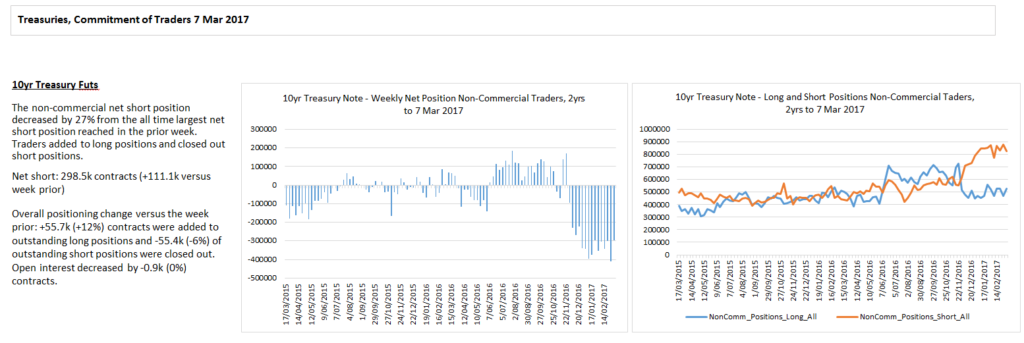

The next key opportunity I am focused on is the long US bond trade to bet against the herd:

(i) The EW structure tells us the 9 month decline is ending

(ii) Bearish sentiment is at an extreme

(iii) Bears are “all-in” short

(iv) FOMC / PPI / CPI this week likely will trigger a bullish reversal

(v) Bank stocks are likely topping

The other trade setup I like is long GBPUSD:

(i) The EW structure is bullish

(ii) Bearish sentiment is at all time extremes

(iii) BOE later this week

(iv) FTSE looking very toppy here

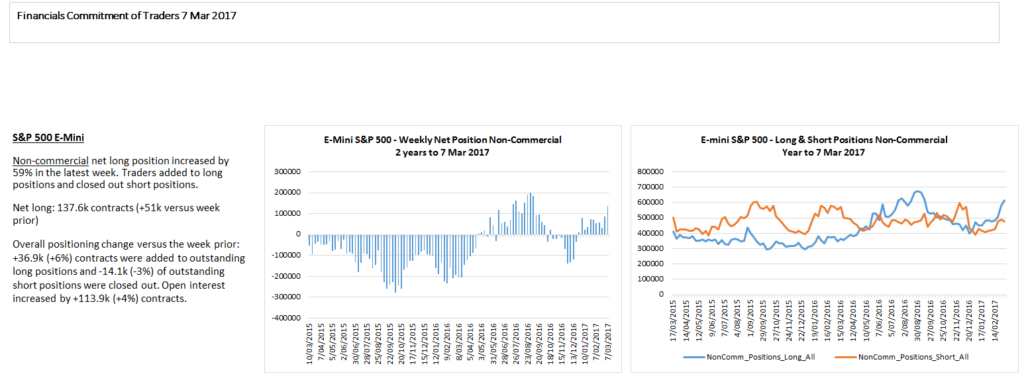

To the equity markets and US equities continued to chop lower, led by the Russell and small caps while the Nasdaq remained the strongest. The declines are not clearly impulsive as bulls and bears fight it out at the end of wave 3. I continue to believe that risk remains to the downside near term as this 4th wave of intermediate degree unfolds. The SPX completely closed its Trump rally gap as expected and found support at the 21 day sma. While we cannot discount the potential for a marginal new high towards 2410, I think this is akin to picking up pennies in front of a steamroller. 4th waves are tough to trade. The bigger picture structure remains in a bull market long term.

The ES structure continues to be choppy (but descending) and we didn’t get a good r/r short signal last week. I still think the safest bet is to trade the extremes and bigger picture levels and not chase this whipsawing market. I still prefer shorts around the 2380-2390 area as I think they are better r/r than being long at this time. I will tweet a trade setup if I see something I like.

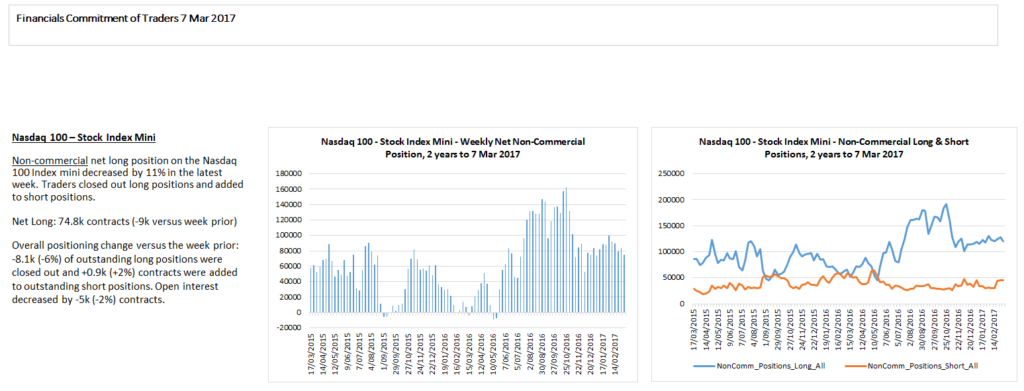

Bulls are still believers and have added to longs up here.

The Nasdaq, Banks and DJIA all had inside weeks and are at risk of failure here to coincide with this week’s FOMC meeting. I expect volatility to increase in line with my strong bond outlook. I am alert to a break of weekly exponential trend support in the Nasdaq likely triggered below last week’s lows. The uptrend has NOT been broken yet so it’s best to wait for confirmation IMO as it still looks strong.

If I am right about an impending bullish turn in bonds, I suspect the banks will take the biggest hit so I am watching for an inside week and down. Also note that the XLF is at an interesting juncture in its Elliott Wave structure and long term FIB resistance. I don’t really trade equities and ETF’s but I am tempted to buy some puts here.

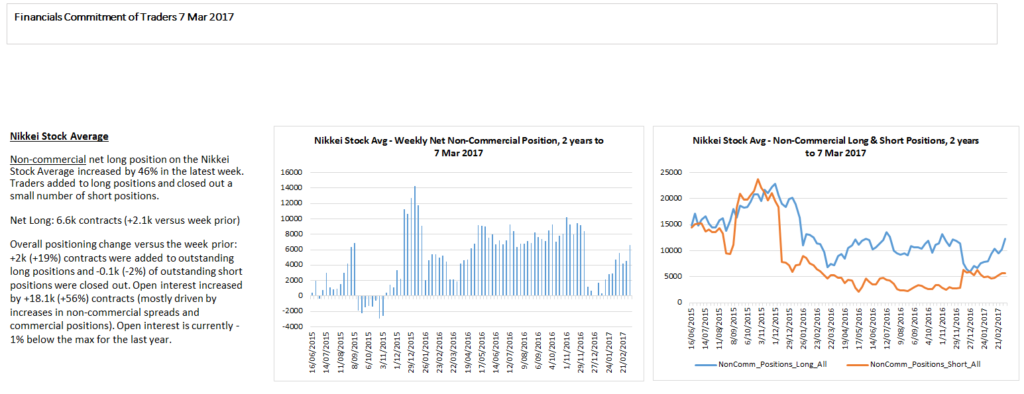

The NKD bounced strongly from the support area we identified for the 4th wave triangle and is now challenging strong overhead resistance. I see two main potential counts here: (i) 5th wave triangle thrust up towards 20500 to complete 5 of (C) or 3 (black count) and (ii) an ending diagonal 5th wave (red count) which should remain below 20012 to remain valid – Importantly, both of these structures are ending waves so longs should be cautious here.

Nikkei traders are all anticipating a break-out and continue to add longs.

The ASX200 also appears to be putting in the final waves to end this rally. I am not convinced of the bigger picture count but I am alert to failures of rising wedges (ending diagonals). Risk remains to the downside here for the Aussie market. Ideally, I would like to see a spike to new cycle highs followed by a bearish reversal. That would be a short setup I would be interested in taking.

The European indices also appear to be completing wave 3 rallies and risk remains to the downside. Ideally the Dax makes one more marginal new high to complete its ending diagonal wave (v) of 3 before declining in wave 4 shown below.

The Eurostoxx50 pushed higher last week and now has enough waves in place to complete wave (v) of 3. While this small degree 5th wave may extend for one more marginal new high to align with the DAX, I am alert to a bearish reversal here this week and will be looking for short setups.

The FTSE which has been a market leader (assisted by the weaker GBP) also appears to be completing wave (v) of 5 with natural targets in the 7433 area. This index is particularly vulnerable given my outlook for a strengthening GBP this week. We have momentum divergences appearing across multiple time-frames but it refuses to die just yet.

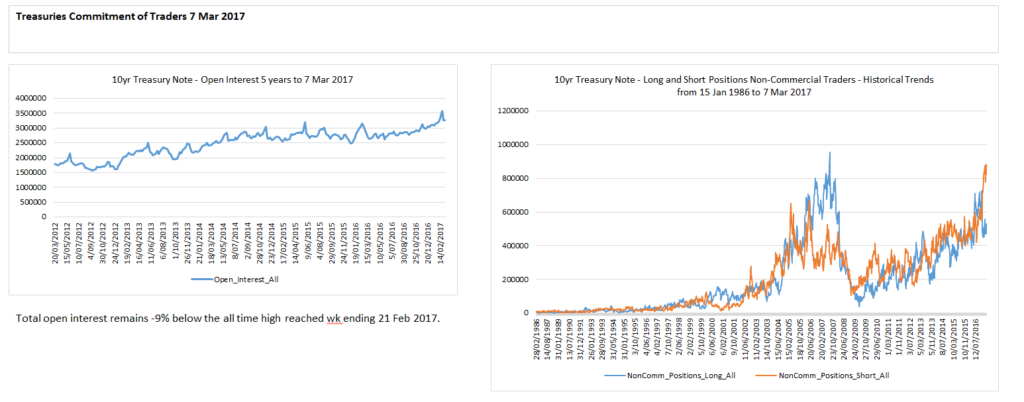

To the bond markets and yields have made new cycle highs as expected (new price lows). Remember, this is a terminal (ending) move in the US bond markets and I expect a bullish reversal this week.

Treasury shorts remain at extreme historical levels…

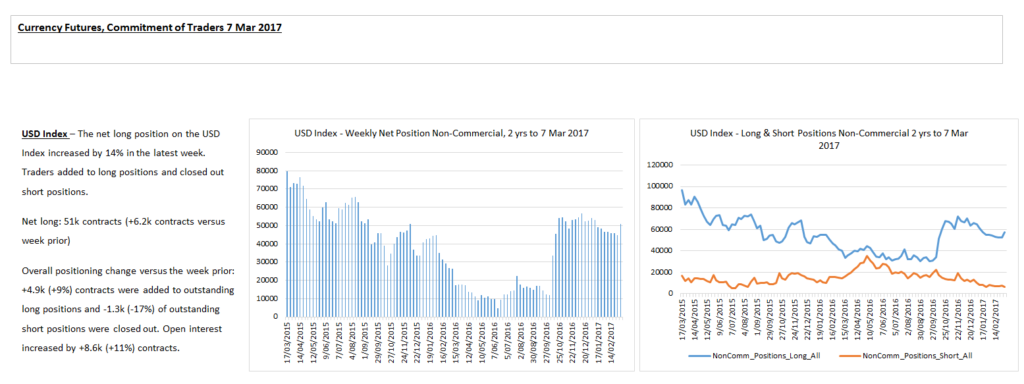

To the FX markets and my call for a weaker US$ against consensus appears to be playing out. The rally from the wave A lows is clearly corrective and should be fully retraced with wave C targets below 99.00. So far the decline is only in 3 waves of equality so we must be mindful of the potential for a more complex correction but the DX turned down from 0.618 Fib resistance so remains bearish until proven otherwise.

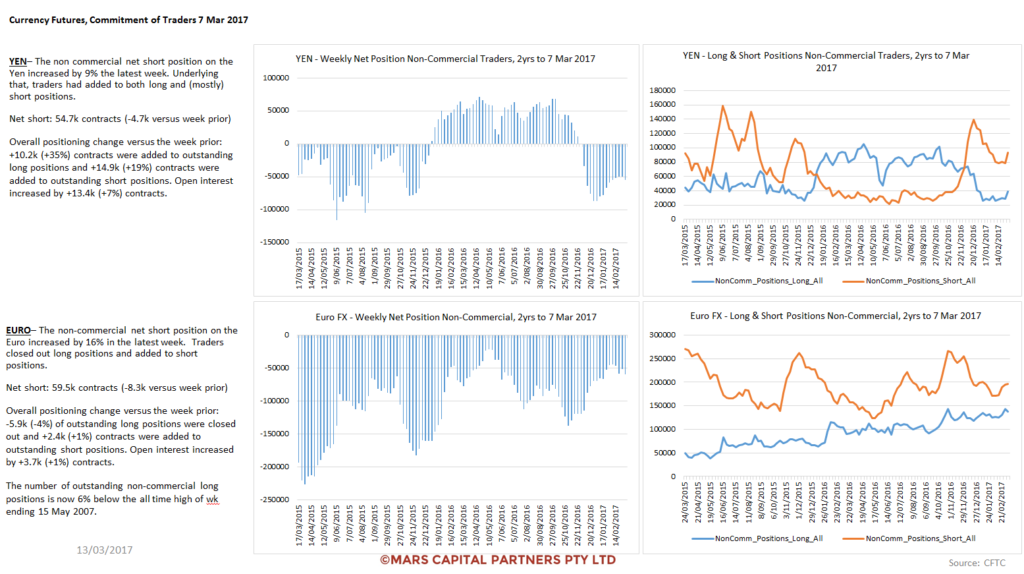

The Euro remains the cleanest pattern as described last week and has the potential to rally back towards the 1.0930-1.0980 area to complete wave C of (2). Our initial target of 1.07 has already been met but the wave structure does not look complete. I remain bullish the Euro until proven otherwise.

The USDJPY pushed to a marginal new high above wave (a) which is a minimum expectation for wave (c) of B. I suspect the USDJPY will push to new cycle lows in line with the broader US$ complex. This is still not the cleanest structure but I find it hard to be bullish this pair given it reversed lower from a cluster of Fib resistance.

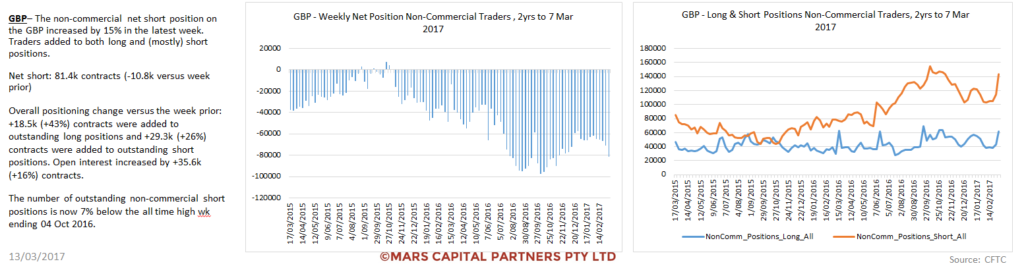

The GBPUSD is setting up as my favourite long trade setup right now. With extreme bearishness and a corrective decline that is currently holding key support, I like the long side of this trade against the January lows. The BOE later this week should help this trade with minimum upside targets in the 1.26 area and potentially much higher.

Extreme bearishness in the Pound continues… into support

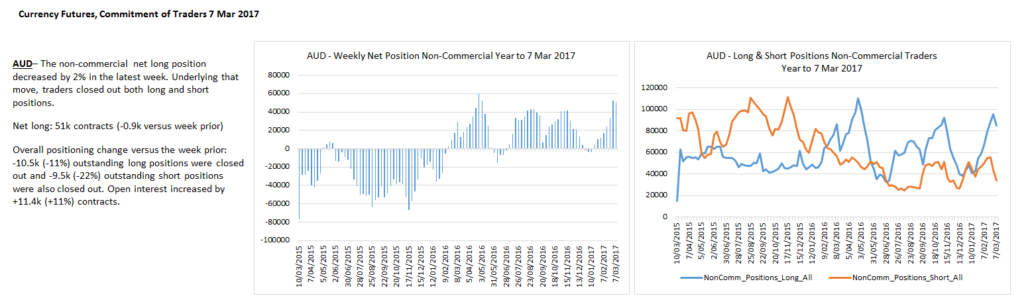

The Aussie$ achieved our minimum downside objective at 0.7520 so I am neutral here. The decline can be interpreted as impulsive so I need to see the structure of the rally here to determine where we are in the bigger structure. We have no edge here in the middle of the range. I would expect strong resistance in the 0.7630 area which may set up our next trade.

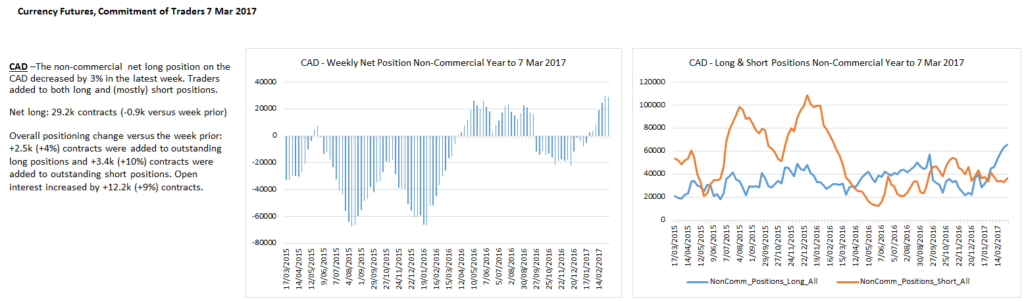

The USDCAD continues to frustrate as I await the 1.38 area for better shorting levels out of this multi month congestion. I would prefer a few more shorts to get squeezed first before committing to the short side. Patience.

Long CAD traders are still wrong.

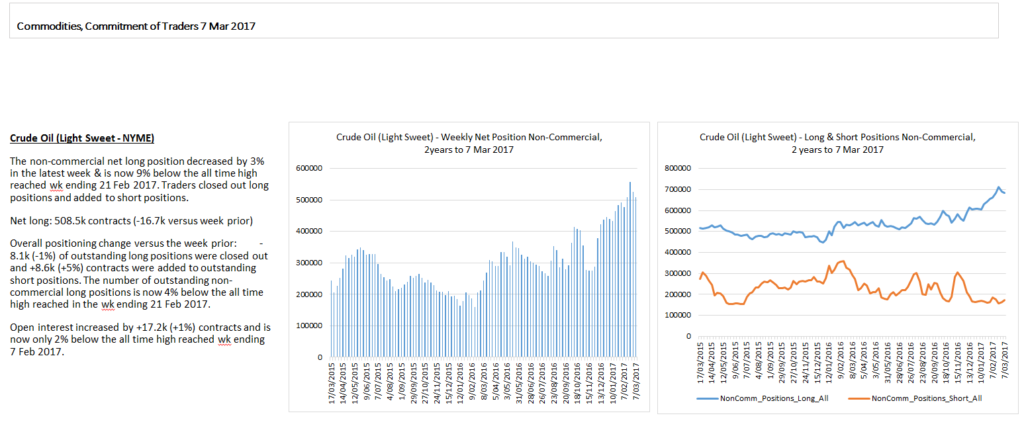

To the commodity markets and the over-committed longs got killed last week in CL, Brent and Silver (commodities showing the most extreme bullish readings). However, I believe this decline is the corrective 4th wave we were looking for. This week is a big test for Crude Oil and Brent. We are now testing the weekly 50 sma along with our 0.50-0.618 Fib support targets. I would like to see an early flush lower to support and evidence of a bullish reversal to get long.

Historically extreme long positions would have hurt…

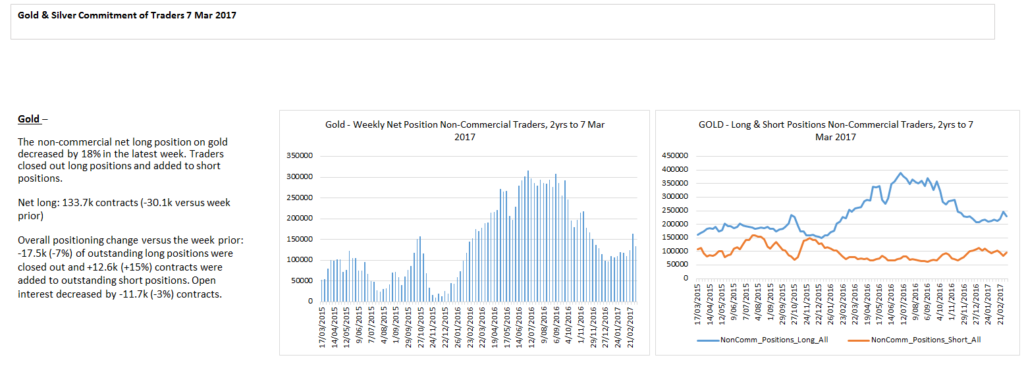

Gold is attempting to break out of its declining trend channel after it found support at the 50% retracement. If we hold last week’s lows, I will be looking for a wave (b) rally towards 1235 or something much more bullish (green 2 low) which assumes that ALL of wave 2 down is complete and we make new cycle highs towards 1300 (aligned with our weaker US$ outlook).

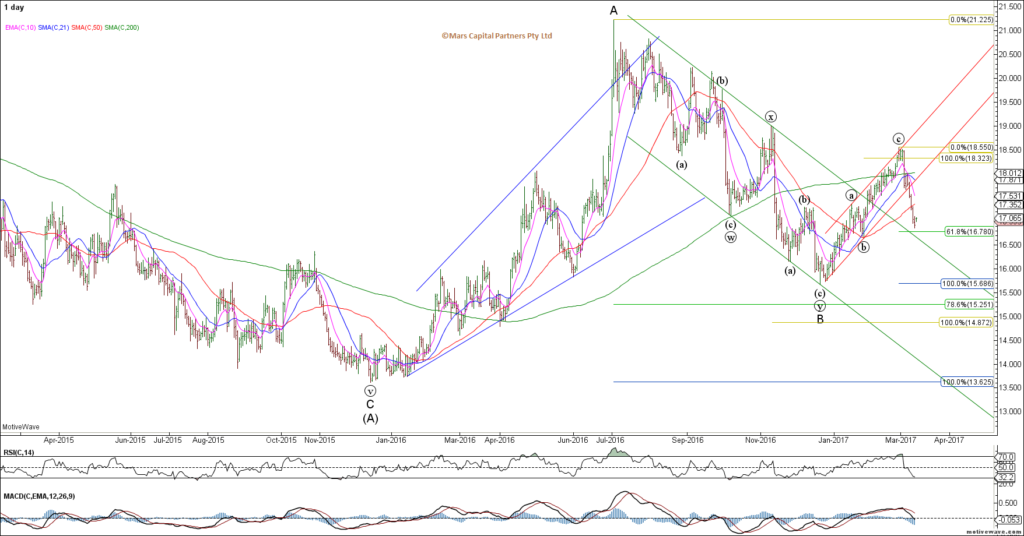

Silver got crushed again last week so I would be more reluctant to go long especially considering the rally off the December lows is corrective. I have no interest in trading Silver here even though it is currently testing 0.618 Fib support.

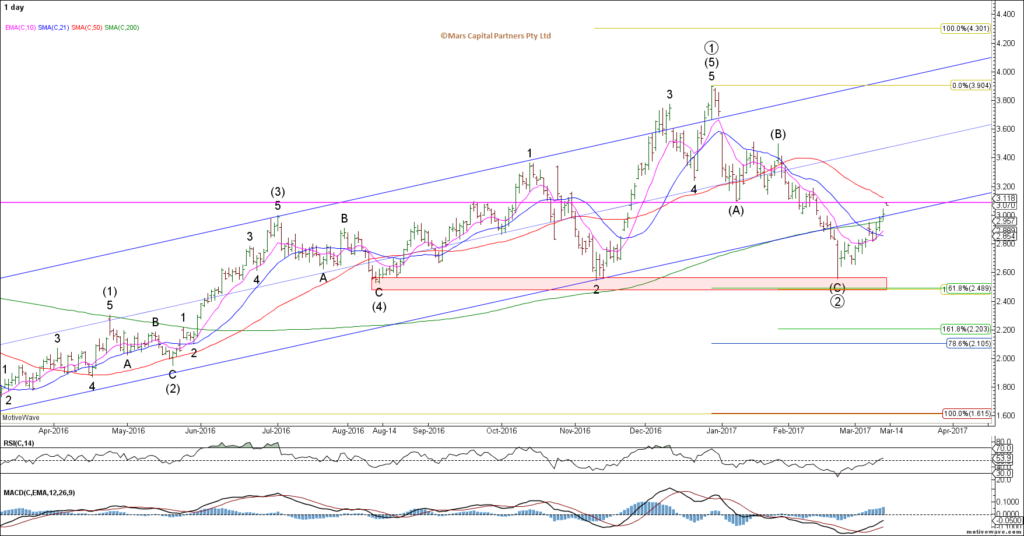

Natty Gas made a liar of me and we didn’t get to buy it at 2.50. The rally from the recent lows looks impulsive and has now run into strong overhead supply (wave (A) lows). Importantly, the decline from the 3.90 highs is only in 3 waves (corrective) so I will be looking for a 3 wave pullback that holds above 2.50 to get strategically long Natty Gas. I’m not chasing it here into 50 day sma resistance.

Natty Gas traders are effectively neutral here.

That’s all for now folks. Have a great week 🙂