As we look forward towards 2018, let’s focus on some bigger picture themes:

- Global Central Bank money printing and interest rate suppression has distorted financial markets pushing investors further out on the risk spectrum. This is at a time when global debt and deficits are all time highs while global demand continues to stagnate – what happens when global rates start to rise as we are forecasting…

- The rise in Passive Investing in ETF’s (aka: anyone can do it), demise of Macro Hedge Funds and rampant speculation in Crypto-currencies (which aren’t currencies at all) suggests we are nearing a top of this speculative mania

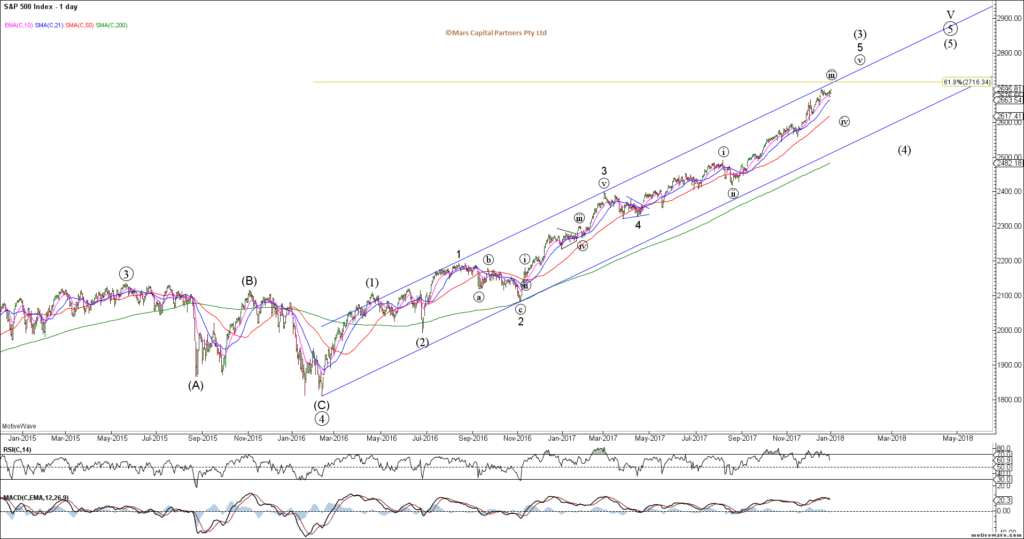

- Global equities remain within bigger picture wave (5) rallies that commenced in 2009

– we expect global equities to top in 2018

– wave 5 of (5) started in February 2016

– while upside targets have been met, we have very little evidence to suggest an end to the rally

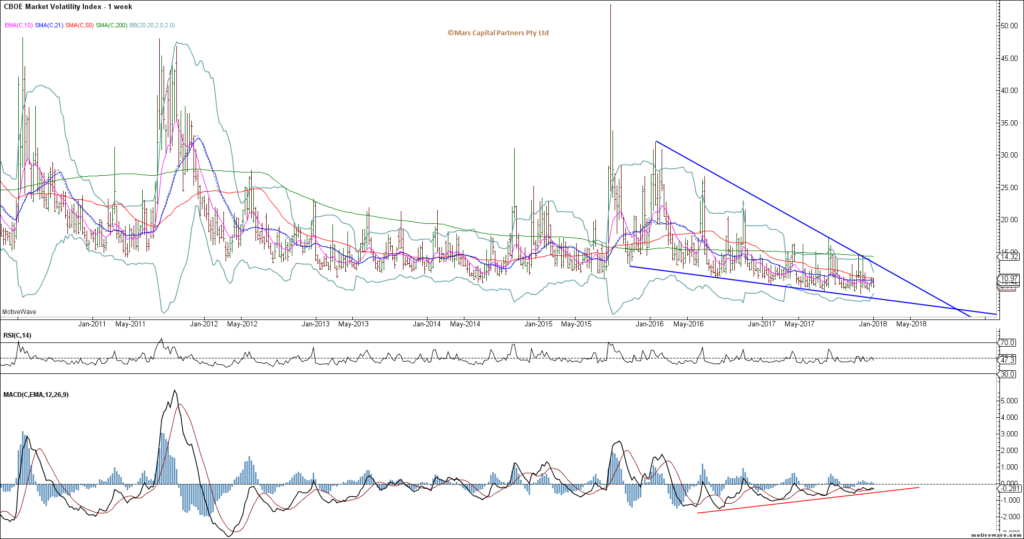

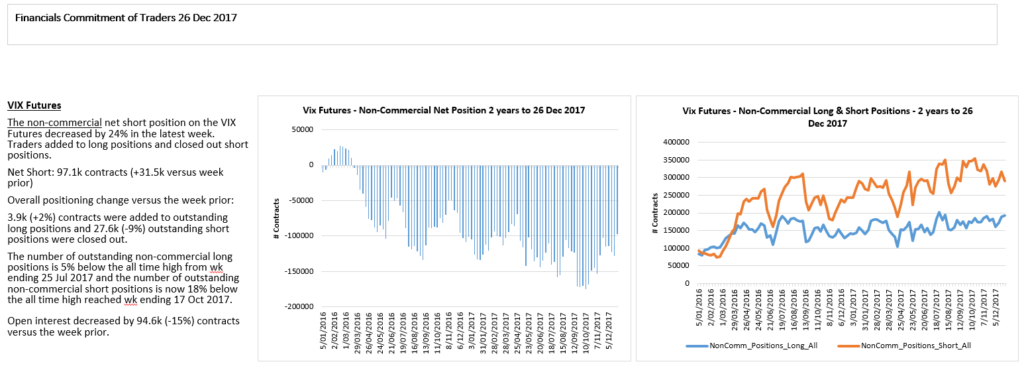

– VIX continues its wedge compression as we look for an expansion in volatility in 2018 - Global bond prices topped in July 2016 from where rates rose until March 2017

– 2017 started a wave 2 correction but it is unclear whether this correction is complete

– bearish Bonds - 2017 saw an impulsive decline in the DXY and rally in the Euro that is nearly complete

– we should now be in the 5th and final wave of this decline

– therefore we should expect a bullish turn in the US$ in early 2018 - Crude Oil should be completing its wave 4 corrective rally that began in February 2016

– looking for a bearish turn in CL to ultimately take out the 2016 cycle lows

– this will likely catch the most crowded trade wrong footed and coincide with a stronger US$ - Gold and Silver are ending multi-year wave (B) triangles that should terminate very early 2018

– bearish PM’s thereafter as we target Gold at $700 - Expect Commodities and US$ to turn together

Last year we forecast a strong equities rally targeting the 2500 area for SPX – the rally has been stronger and longer than expected as Central Banks pulled back from the idea of reducing QE. Momentum remains strong and the absence of a clear 4th wave of intermediate degree suggests this bigger picture rally isn’t done. We are counting this rally from February 2016 as wave 5 of V – an ending wave to this entire rally from the 2009 lows. Once this trend exhausts, we will be looking at trading from the short side because “IF” we are correct, this entire 8 year rally should be retraced. Our next measured upside target is where wave (5) equals 0.618x waves (1)-(3) which resides at 2716. We have no reason to fight this until we see evidence of a bearish reversal. 2018 is likely to feature increased volatility as we unwind 4th and 5th waves into the end of this rally but we’re not there yet.

The Daily SPX chart suggests we remain in the wave (3) rally with waves (4) and (5) to come. There are no signs of a tradable top but we are alert to a change in sentiment given the extreme bullishness. This year, we will be on the lookout for an impending market top and potential triggers for this to occur – first and foremost the wave count must be complete (no signs of this as yet) and the bullish paradigm needs to shift – likely triggered by rising yields and US$

ES continues to rally impulsively and decline correctively. Until that changes the bulls remain in control but momentum is deteriorating.

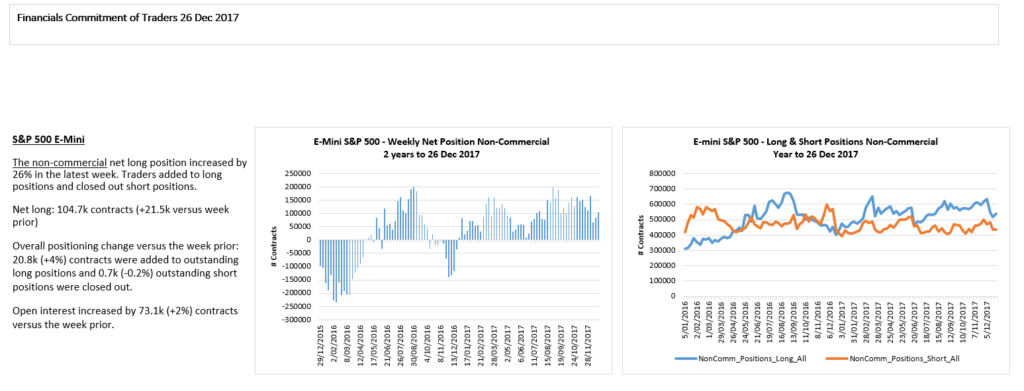

Interestingly, while equity traders are all-in, this is not the case with futures traders who remain partially hedged.

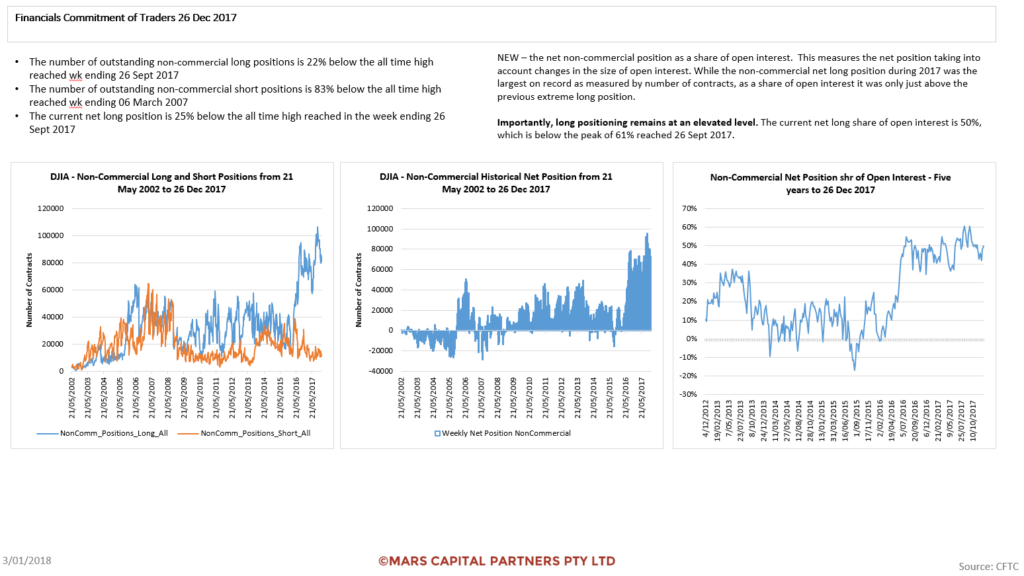

The DJIA has been the strongest index supported by the weakening US$ throughout 2017 – our expected bullish turn in the US$ will likely cause the DJIA to underperform in 2018.

The YM COT data shows the strength of this rally despite the pull back in futures longs. Physical equities leading the way.

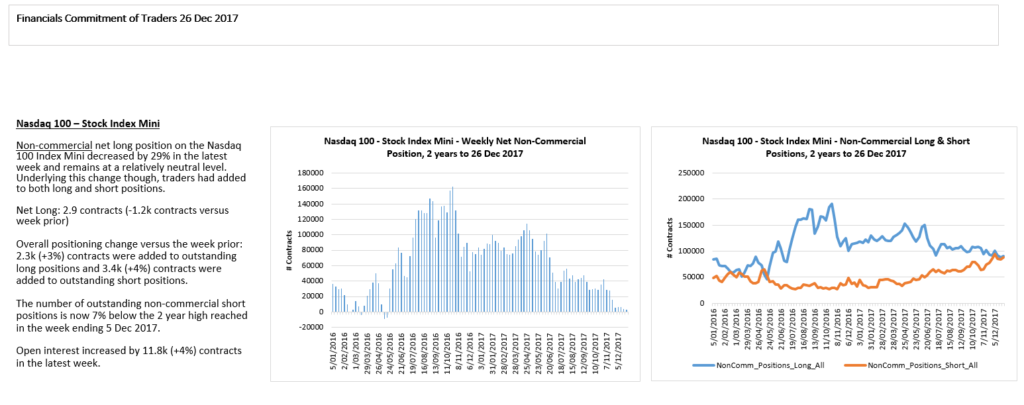

The Nasdaq continues to subdivide higher in wave (3) supported by the 50 day sma and trend channels. This chart is more illustrative of declining momentum but as long as we continue to make higher highs and higher lows coupled with impulsive rallies and corrective declines, the trend is your friend until it bends. While we expect this rally to terminate at some point during 2018, I would prefer to see a clearer wave (4) and (5) play out first. In the meantime there has been no reason to alter our bullish stance.

The near term NQ chart clearly shows the recent trend channel and likely push to new ATH’s.

NQ traders have been actively hedging as prices advance. Note the high level of shorts causing this squeeze.

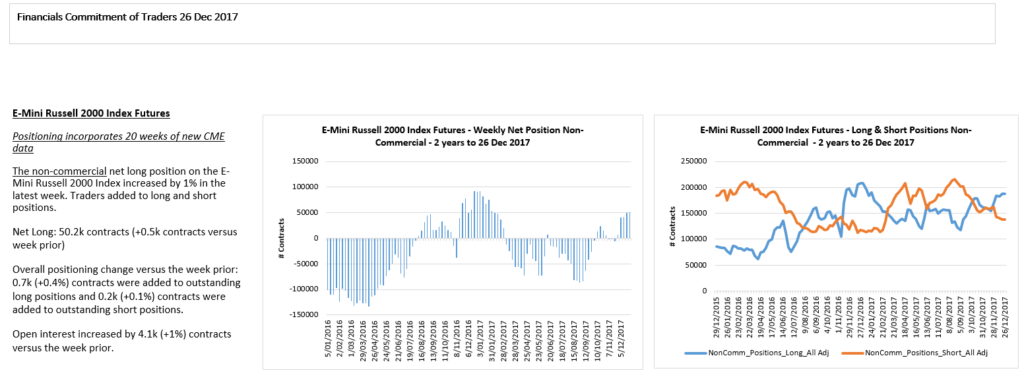

The Russell 2000 looks the most vulnerable of US equity indices as we wedge into yet another high. The overlapping nature of the advance suggests an ending wave to complete wave (3) prior to a wave (4) decline towards the 200 day sma. Remember, this rally from the 2016 lows is an ENDING wave 5 which should be fully retraced on completing to this rally.

The near term count (ending diagonal) suggests one final push higher for wave (c) of (v) of 5 before a bearish reversal. Trade above 1615 would invalidate this count as wave (iii) would be the shortest. Stylized pattern is shown below. Topping.

The RTY COT data shows shorts squeezed out again which makes this index more susceptible to a decline near term.

The DJ Transports are currently in wave 3 of (5) after bouncing off the 200 day sma we highlighted some weeks back. We require another wave 4 and 5 to potentially complete this multi-year rally.

The VIX compression continues to wedge lower – ever tightening. Do you really want to be a seller of volatility here? Take note that momentum continues to make higher lows as per the MACD. This was the most crowded trade for 2017 – I am looking for a bullish reversal early in the new year as volatility expands. The market is gifting cheap protection so I suggest you take some…

VIX shorts remain elevated but not at recent extremes.

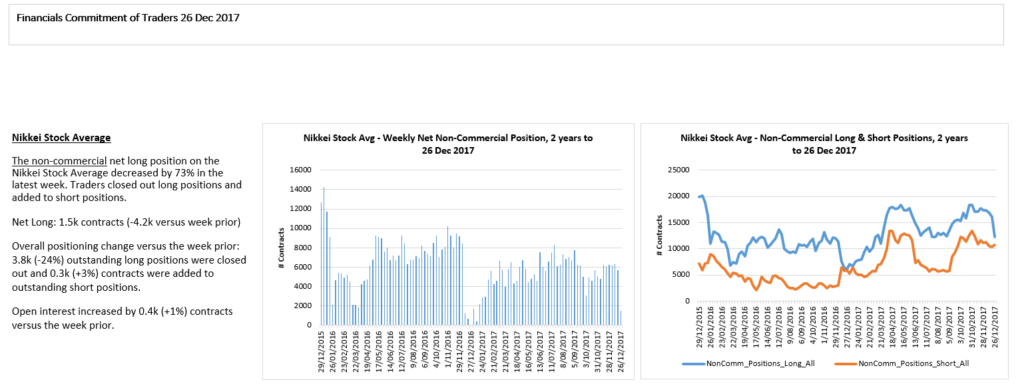

To the global equity markets and our 2017 Year Ahead Review highlighted the need for new highs in the NKD and DAX which have both performed as expected. NKD pushed strongly to new highs but the rally is incomplete. We are currently in a small degree wave (iv) of 3 with the expectation of (v) up towards 24000 to complete wave 3 from where we should see a larger degree wave 4 and 5 to complete the post-2009 rally.

Near term the count is unclear but we appear to be forming a contracting triangle. The question is whether we retest the 21800 area (black count) prior to wave (v) up or just push directly higher from here (red count) – the near term count is unclear. Either way, we should expect new cycle highs for the NKD.

The ASX200 (SPI) pushed to new cycle highs which was not expected earlier in the year. It has reluctantly followed the global equity market theme higher. This overlapping rally is likely doomed to fail but the wave count is unclear. I am looking for opportunities to short this index when we get confirmation of a turn – in the meantime I am not fighting this.

We are looking for the DAX to complete its multi-year rally in 2018. The DAX appears to have completed wave (3) of (5) and we should now be in wave (4) of larger degree. I would like to see a deeper correction in price and time before the next wave higher for (5). There is a confluence of strong support in the 12650 area with Fib, trend and 200 day sma intersecting. A break of this likely sees 12000.

Last week we got the near term decline we were looking for but short of downside targets. Bears need downside follow through and keep the DAX below 13000 to maintain bearish momentum or risk another rip higher to retest the cycle highs forming a more complex correction.

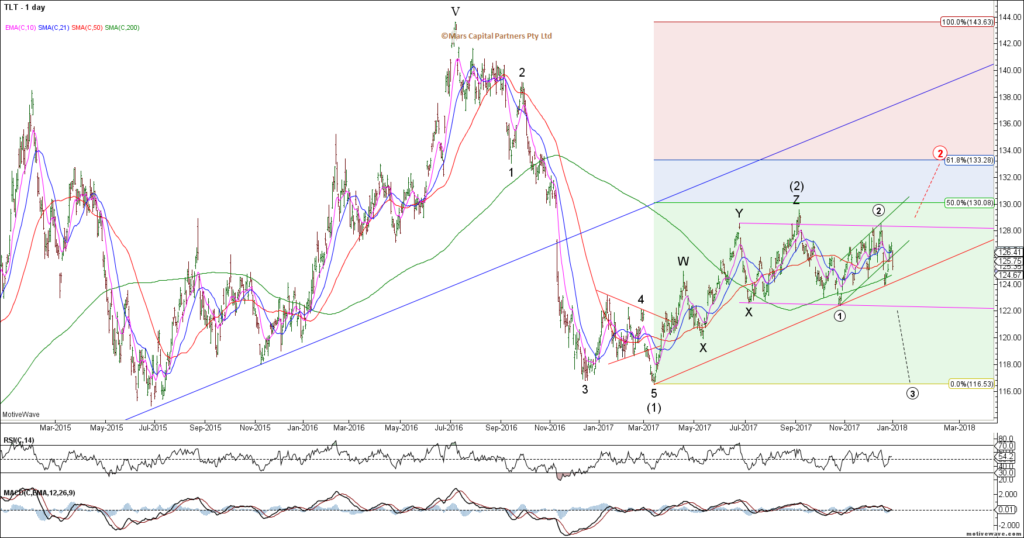

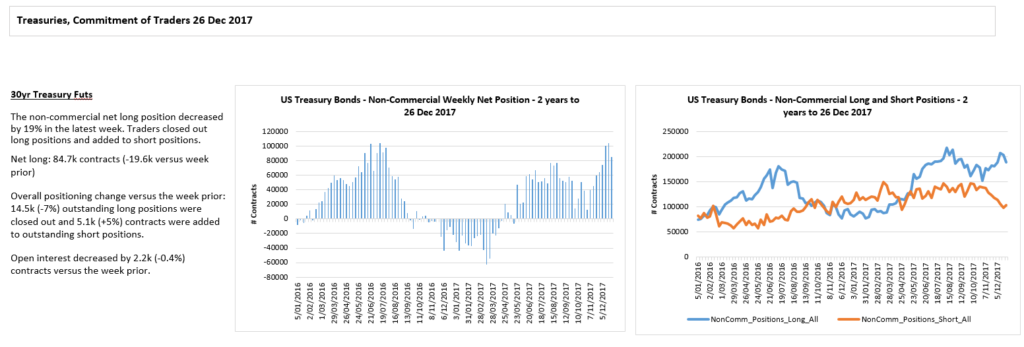

To the Bond markets and as predicted in our 2017 year ahead review, we saw a wave 2 corrective rally develop throughout the year. We remain bearish from a bigger picture perspective as our base case is that rates bottomed in July 2016. We are looking for much higher rates later in 2018 (bearish bonds). The TLT chart shows the clear impulsive decline from the July 2016 highs – next we can see an overlapping corrective wave structure that either ended at the September highs or another push higher towards 133 as per the red count. We also have a potential H&S top formation with a neckline break below 122.00 likely to lead to an accelerated decline towards 117 and potentially much lower. In the meantime we are just range racing between 122 and 130.

The US 30yr chart looks less clear from a near term perspective although the bigger picture theme remains (bearish). I was looking for a push higher towards the 155’00 area to establish new shorts which would help clear up the structure and give us a cleaner count.

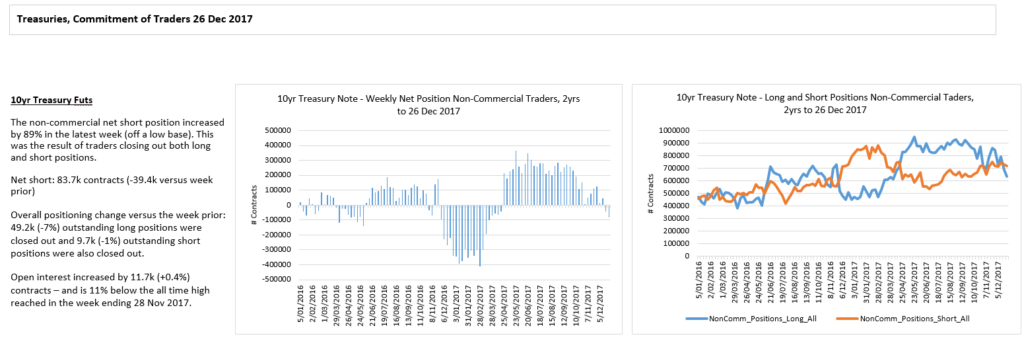

The TY looks less clear as the decline from the September highs does not look particularly impulsive. Expect strong support in the 122-123 area. Bigger picture we remain bearish but I am reluctant to short into strong support here. I’d rather be short from higher levels.

From a near term perspective, the decline is NOT a clear impulse although it can always extend lower. Looks to me that it is wedging into a low and I’d watch the near term red trendlines for guides. Maybe this red count below? Wary of a near term bounce from this support area previously highlighted.

The German Bund is less clear and appears to be trapped within a larger triangle – merely range racing for the last 18 months. I have no strong view on the Bund as triangles can break either way. 158.73 is critical support.

The Japanese JGB also appears range bound within a corrective channel consistent with the BOJ’s bond buying program – the structure looks like it needs higher towards 152 before the bears have a chance to potentially reverse this trend.

The Aussie 10yr Bonds also looks like they need higher towards 97.75 setting up a bigger picture H&S (double right shoulder) before the bear trend can resume.

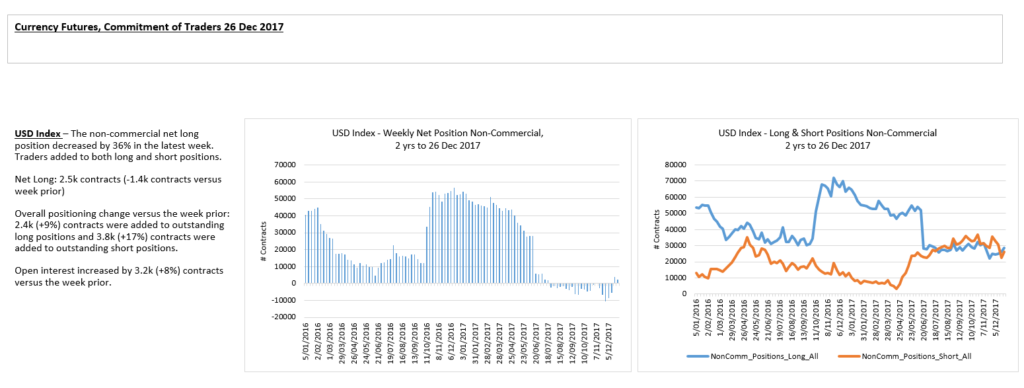

To the FX markets and after declining throughout 2017, the US$ is due for a strong bullish turn in early 2018 once 5 waves down is complete from the January 2017 highs. The world is universally bearish the US$ now which is the ideal time to look for a turn. We should expect this decline to terminate in the 90.00 area for the DXY. Our anticipated bullish US$ turn will have important implications for the commodity complex which we expect to turn bearish in 2018.

We need to see a complete 5 waves down to new marginal cycle lows in the 89.50-90.50 area before we can turn bullish the US$ as shown below.

DXY traders remain flat for the last 6 months.

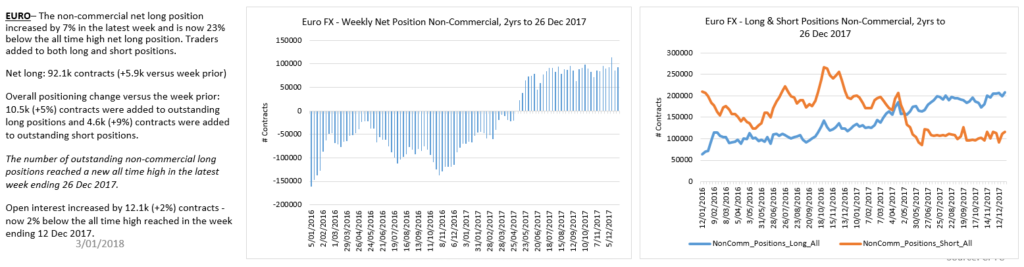

Like the DXY, we are looking for this year long Euro rally to end in early 2018 and completely reverse as we head to new cycle lows and parity.

This correction in the Euro from the 2015 lows is counted as an expanded Flat (3-3-5) with wave (C) targets at 1.618x wave (A) in the 1.23-1.24 area as shown below. Upon completion of wave 5 we will be very bearish the Euro as we look towards parity for this pair.

Euro traders remain long and soon to be wrong.

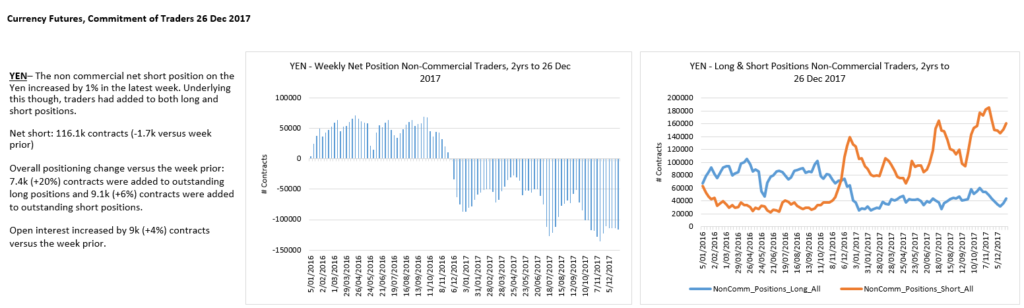

The USDJPY spend 2017 going nowhere and range racing and it is starting to look suspiciously like a bullish triangle / pennant which fits our bullish US$ theme for 2018.

From a near term perspective, a decline towards 110.00 Fib support would present the best buying opportunity while a decline below 107.30 opens the door towards 104.

A decline towards 110 would help flush out some of these short Yen traders.

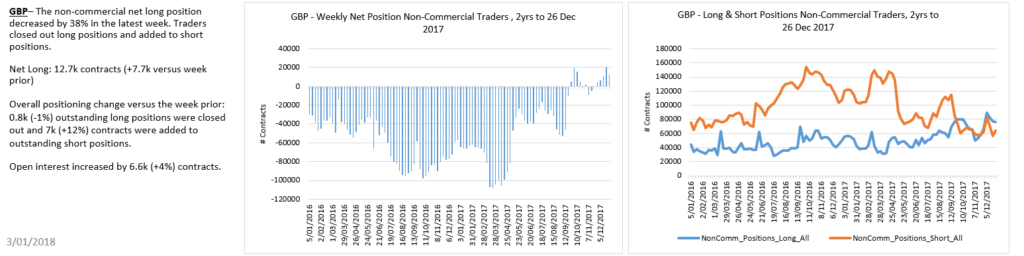

The Pound continues to frustrate and hold trend support. We are still looking for wave 5 of (C) down but we don’t have a clear setup. Trade above 1.46 eliminates this count but I am probably not trading it until I see a clear structure to trade against. My least favourite dollar pair but I think there is significant downside risk with Brexit.

It appears that most GBP traders have given up and are now flat.

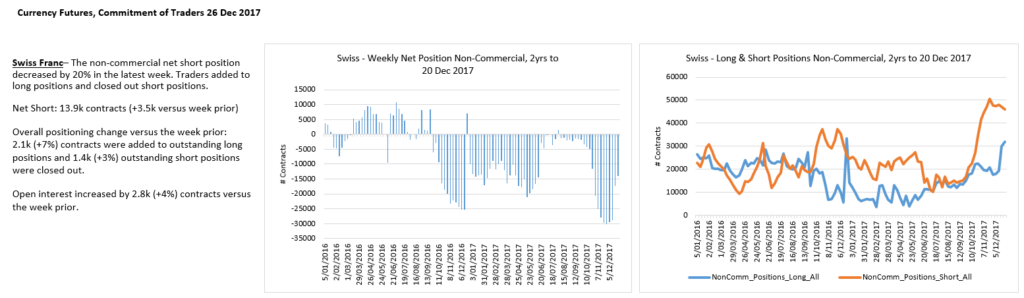

The USDCHF remains range bound but I’d rather be a buyer in the 0.95 area for the next potential leg higher – no clear structure here but underlying sentiment favours the bulls down at trend support.

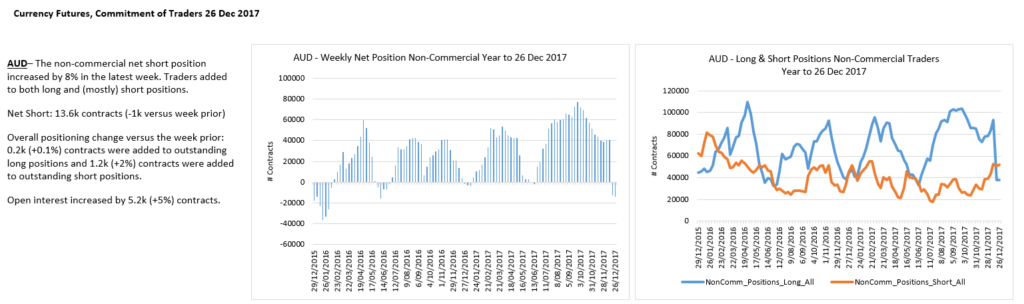

The bigger picture structure shows an A – triangle B – C wave corrective rally from the 2016 lows which likely completed wave (4). Near term, the Aussie$ is approaching our previously defined resistance in the 0.7900 area from where we would look for the downtrend to take hold for wave 3 of (5). Bearish the Aussie$.

Once again, we are looking for the strong US$ to take hold.

Aussie$ longs capitulated at exactly the wrong time…

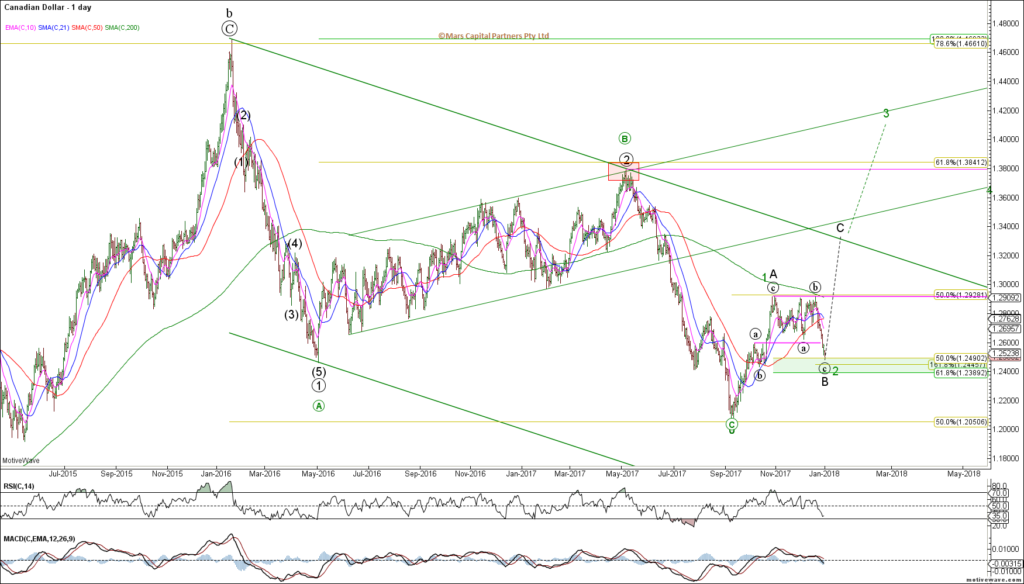

The USDCAD has declined to strong support in the 1.24-1.25 area from where we would look for a bullish turn. US$ bulls need to step up. Bullish USDCAD.

CAD traders now flat after being whipsawed.

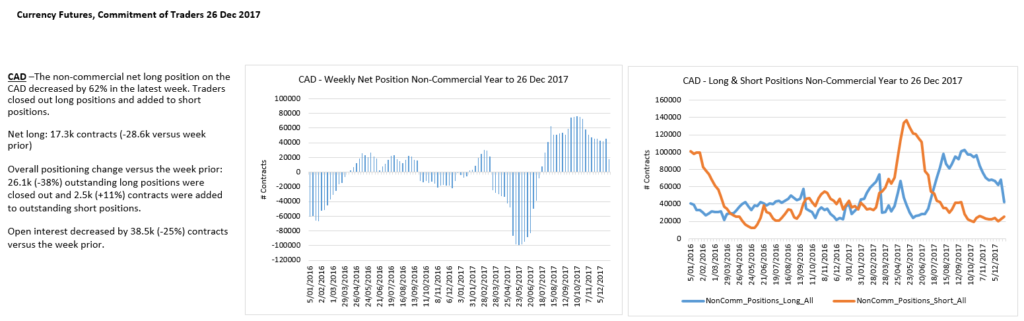

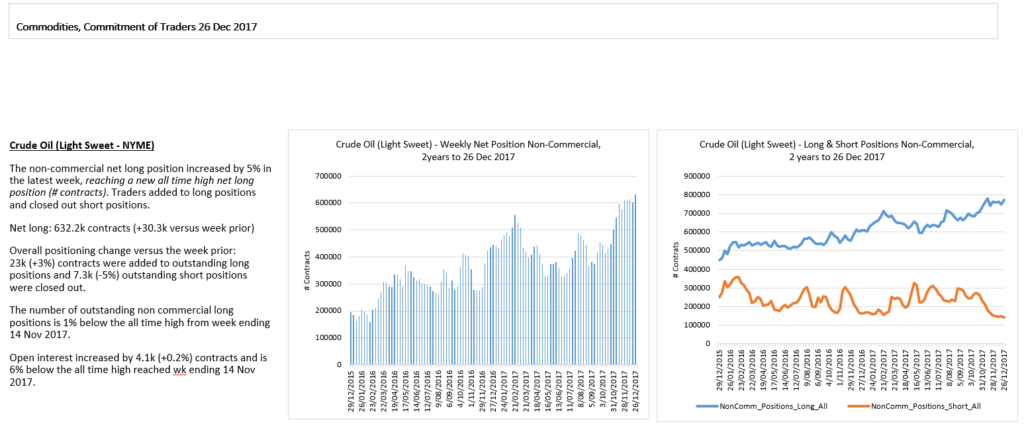

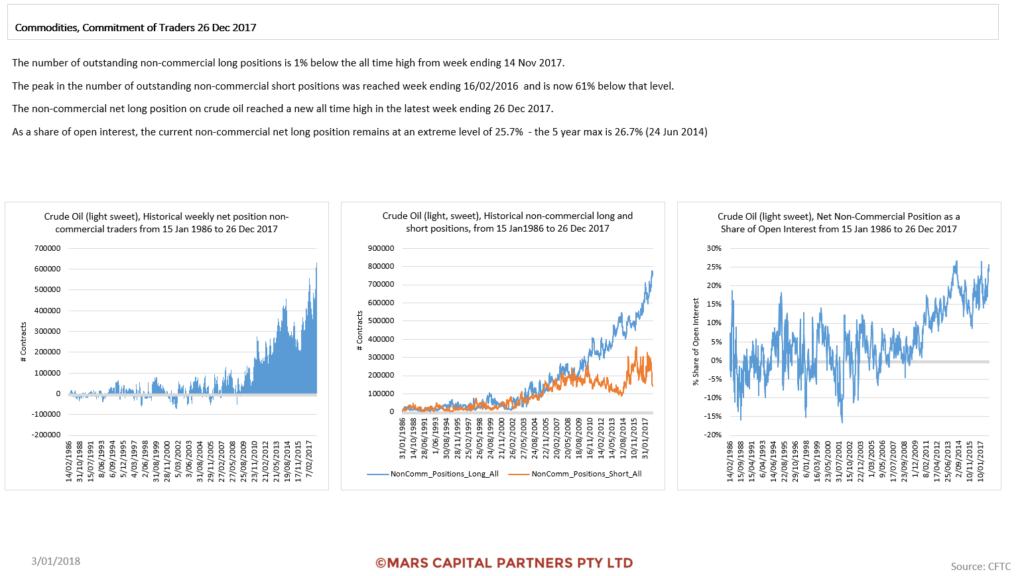

To the commodity markets and “IF” we are right about the impending bullish US$ reversal, the commodities will likely decline as a result. The bearish setups are definitely there. Crude Oil is a particularly interesting short prospect given the extreme long positioning of traders and 3 wave corrective rally into prior wave 4 resistance at 62.50 – our bigger picture structure is looking for a final wave 5 down for new lows below $26. We are alert for signs of a bearish reversal which should coincide with a bullish reversal in the US$. Bearish Oil.

CL should now be in the final wave 5 of (C) where it is vulnerable to a bearish reversal although we have no evidence of this just yet. Awaiting signs of a bearish reversal to get very short against the herd.

Bulls pushing the envelope to new extremes! The longer they get, the more exciting this opportunity.

Perspective…

Brent Crude shows the same structure as we approach $70 resistance.

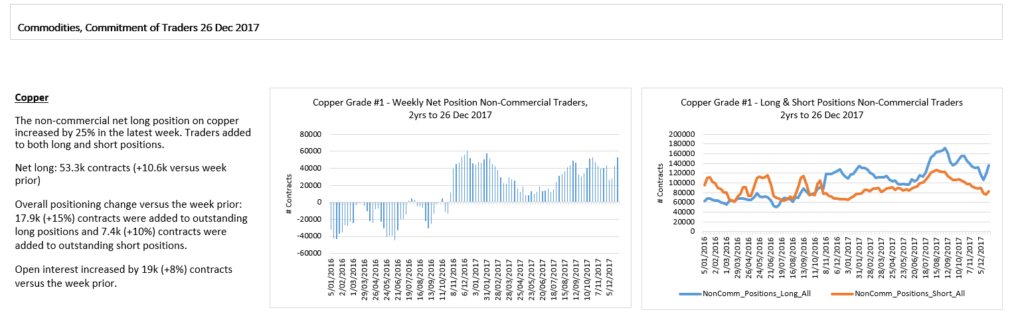

Dr Copper has pushed higher into a cluster of Fib resistance but the structure remains bullish until we see evidence of an impulsive decline – I have no strong view on the good doctor but the rally is extended and I would be looking for at least a correction towards 2.60 on a break of 2.90. I have no strong long term view for HG.

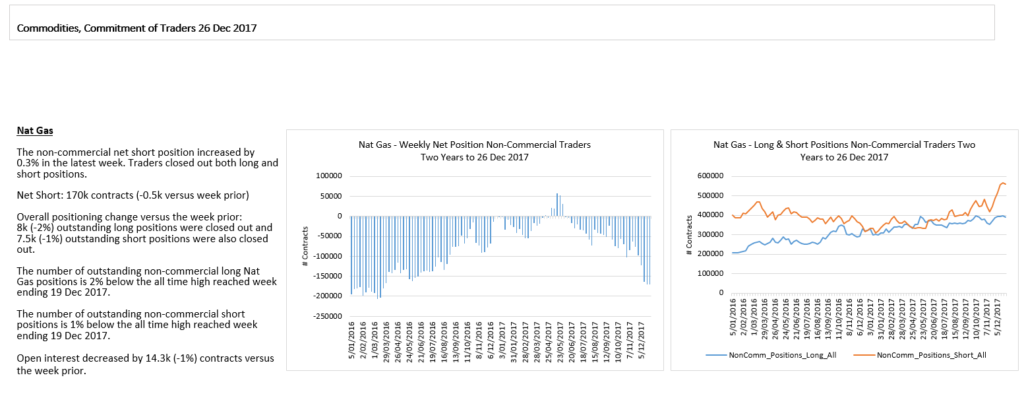

Natty Gas continues to break hearts as it ripped higher from our support area – the count is unclear but we should expect an initial upside target in the 3.40-45 area. I would not chase this but look for a 3 wave correction of this current advance to add longs – the reality is we continue to range trade and we are now back to the middle of the range. I have no strong long term view for NG.

Overloaded Natty shorts have been torched as expected.

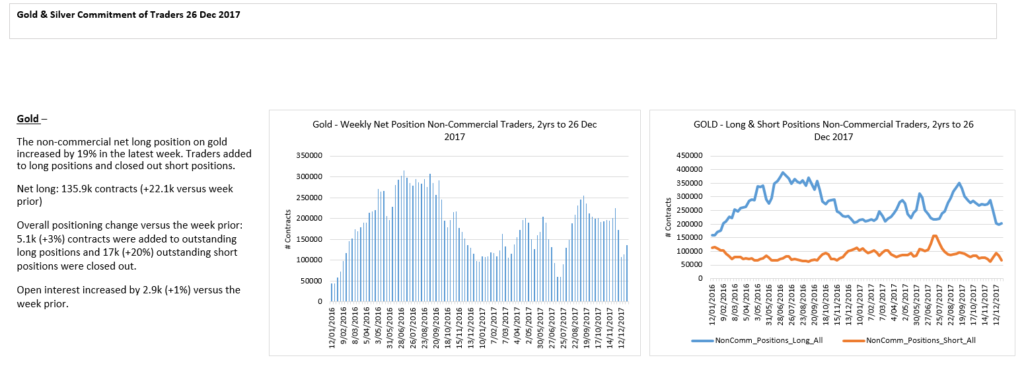

To the PM’s and we remain bearish from a bigger picture perspective. 2018 will likely be the year that Gold declines towards our $700 target which will be where we will be getting very long physical Gold. The immediate question is whether prices turn down from the red triangle resistance or pushes through higher towards 1450 targets. This will largely depend on the US$ in the near term as we look for a bullish reversal.

Interesting that the bulls have been reluctant to jump on this latest rally but still very few shorts.

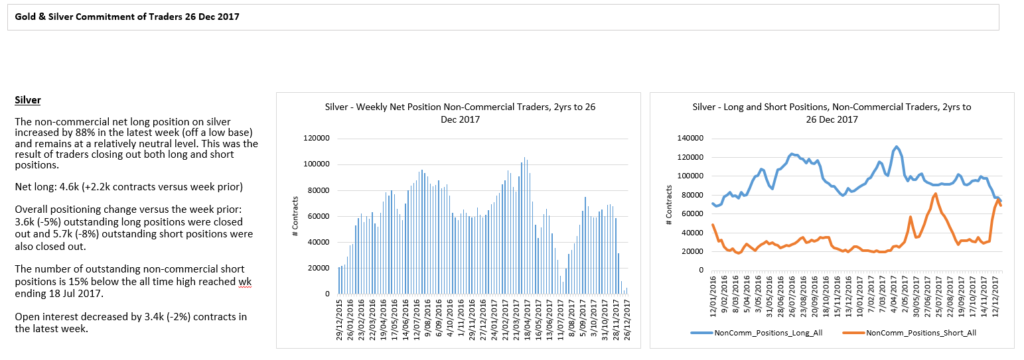

Silver also continues to look bearish from a bigger picture perspective with a continuation of 3 wave corrective structures within a triangle.

Silver shorts smoked again as it rips higher from our support.

That’s all for now folks. Looking forward to a great 2018 🙂